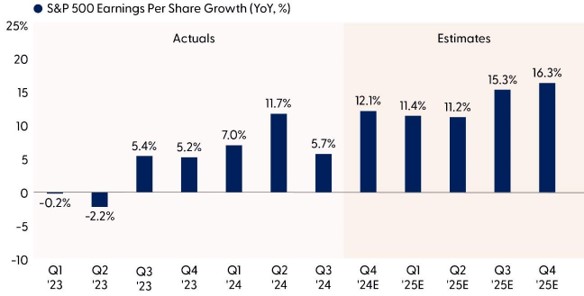

Earnings season is underway and, thanks to the banks, it’s off to a good start. Currently, consensus estimates are calling for a strong 12% year-over-year increase in S&P 500 earnings per share (EPS) for the fourth quarter of 2024. Steady economic growth should be enough for corporate America to beat these estimates, but upside will likely be limited due to several headwinds, including currency. Regulatory, trade, and immigration policies will be a major focus for analysts and investors in the weeks ahead, where this earnings season may bring more questions than answers. Policy developments will have a lot to do with whether Wall Street’s expectations for double-digit S&P 500 earnings growth in 2025 will be realized. With valuations high, corporate America needs to come through.

What to Expect This Earnings Season

A Mix of Strong Growth and Policy Uncertainty. Analysts expect about 12% growth in S&P 500 EPS in the fourth quarter of 2024 currently. We expect limited upside to that estimate this quarter, partly due to the strong U.S. dollar. Excellent bank results last week got us off to a good start. Earnings growth will be strong enough that the amount of upside may not matter much. Given the expected drag from the energy sector, we’ll happily take 13–14%.

The key to the market’s reaction to results will be whether guidance is upbeat enough to keep market expectations for double-digit earnings gains in 2025 intact. To that end, trade policy expectations will be important factors, as we discuss below.

Fourth Quarter May Kick Off Run of Double-Digit Earnings Growth Quarters

Source: LPL Research, FactSet, 01/16/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

At a high level, solid economic growth to end the year puts corporate America in a good position to grow earnings by double-digits in Q4. The Atlanta Federal Reserve’s GDP tracker is calling for 3% GDP growth last quarter, nicely ahead of economists’ consensus forecast of 2.3% (source: Bloomberg). The Institute for Supply Management (ISM) Manufacturing Index, which has historically been correlated to S&P 500 earnings, rose two points during the quarter, though it remains slightly below the expansion/contraction breakpoint of 50. The holiday shopping season was strong with sales gains of around 4%, above the National Retail Federation’s prediction and powered by strong e-commerce sales.

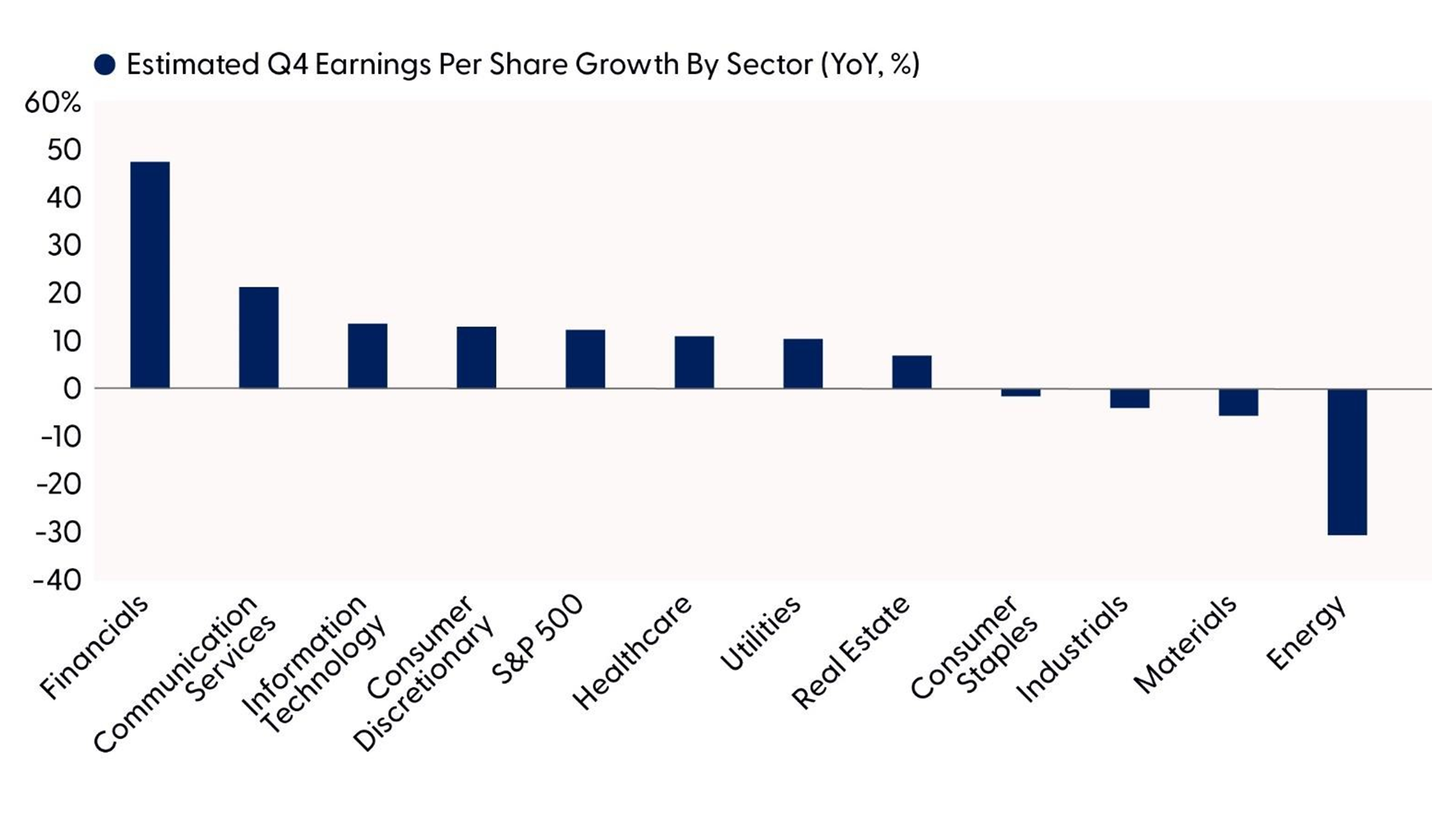

Easy comparisons don’t hurt, as banks took special charges in the fourth quarter of 2023 to replenish the FDIC’s rescue fund after the regional bank crisis earlier that year. That means big increases in bank earnings will be easy to come by when compared to depressed year-ago results. In fact, the financials sector is likely to drive half of overall S&P 500 EPS growth in Q4. That’s more than the five points of earnings growth contribution expected to come from the Magnificent Seven (the seven biggest market-cap companies in the U.S. which are all technology-oriented). As noted in the “Expect Big Growth Divergences Among Sectors This Earnings Season” chart, financials and the big growth sectors are where most of the earnings strength will come from.

Pushing in the other direction will be a strong dollar, higher borrowing rates, slowing growth in Asian tech exports to the U.S. (indicative of technology product demand), and a sizable drag from the energy sector. Energy is likely to be a two-point drag on S&P 500 EPS if the expected 30% year-over-year drop in sector earnings comes to fruition.

Expect Big Sector Growth Divergences During This Earnings Season

Most of the earnings growth in Q4 will be driven by financials and the big growth sectors

Source: LPL Research, FactSet, 01/16/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

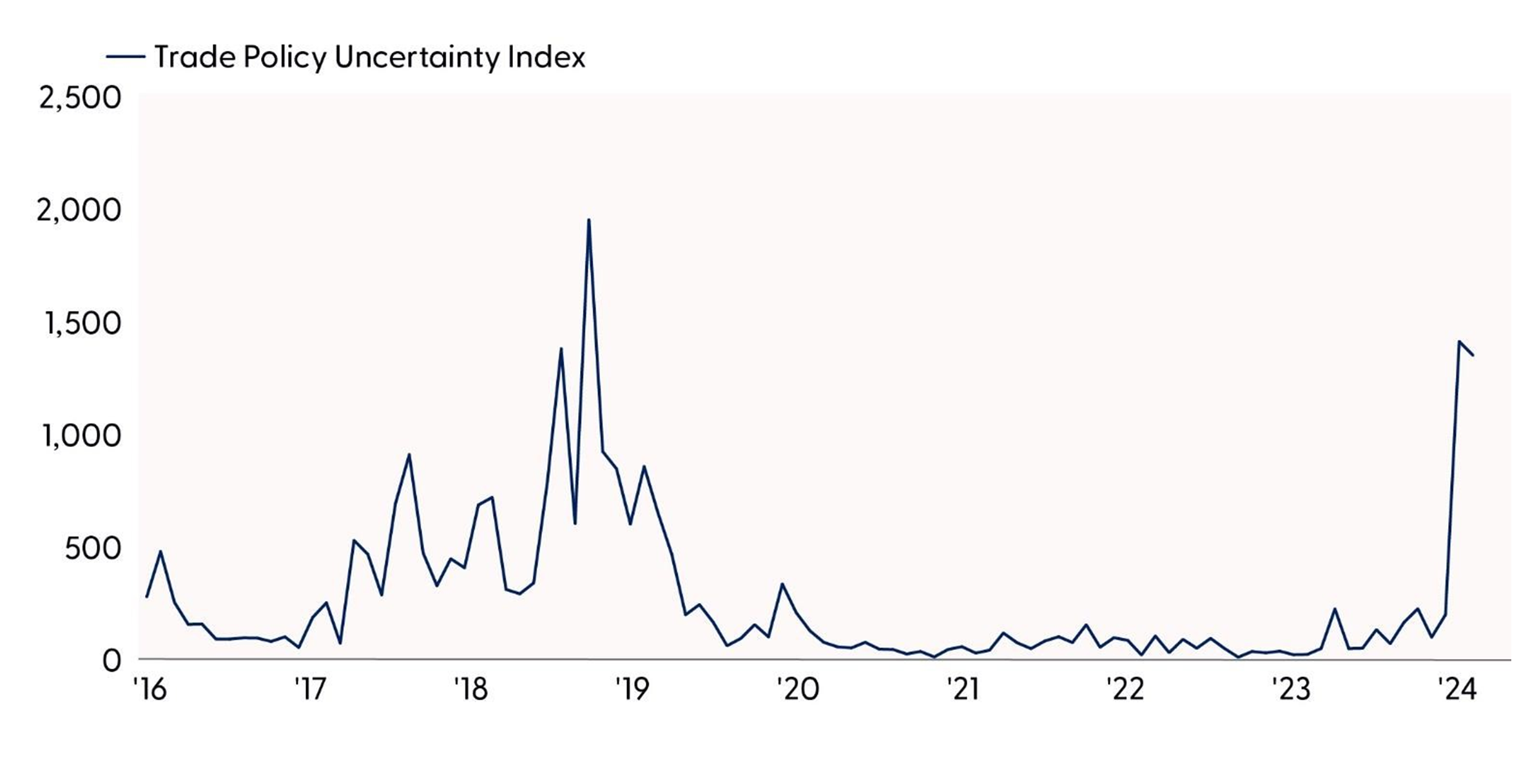

Trade policy and tariffs will likely be a topic of discussion on nearly every earnings conference call for the big multinational corporations that compose the bulk of the S&P 500. Tariffs won’t impact last quarter’s results, but they will have a lot to say about how earnings in 2025 shape up. Remember, tariffs can be raised with executive orders, so they can, for the most part, be implemented immediately without congressional approval. At this point, we don’t know how deep or broad the tariffs will be, but they are likely to cause a bit of a squeeze on profit margins for companies that import materials and unfinished goods from China and throughout Europe and Southeast Asia.

Some of those tariffs will be passed on to consumers in the form of higher prices, which is why some worry they will be inflationary (they might be, but only temporarily). Some tariffs will be absorbed by foreign producers and U.S. wholesalers rather than U.S. consumers (the impact of tariffs on consumer inflation in 2018 was minimal). Foreign currencies may weaken further, minimizing the impact. And many tariff exceptions will likely be granted as trade negotiations play out. Nonetheless, trade uncertainty is high, and retaliation is possible if U.S. actions are more aggressive than our trading partners will tolerate. Even our friend to the north is preparing retaliatory action with a possible tariff on Canadian oil exports to the U.S.

Also consider shifting supply chains to reduce reliance on China, which started in Trump 1.0 and may gain steam in Trump 2.0, comes at a cost (possibly benefiting the industrials sector, which we like, as well as India). And U.S. companies may lose market share to European and Asian competitors if trade tensions ratchet higher. This uncertainty is evident in the chart below.

Trade Policy Uncertainty Surged Ahead of Inauguration Day

Tariffs present a huge potential swing factor for earnings in 2025

Source: LPL Research, Baker, Bloom & Davis, Bloomberg 01/16/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Double-Digit Earnings Growth in 2025 Likely Within Reach

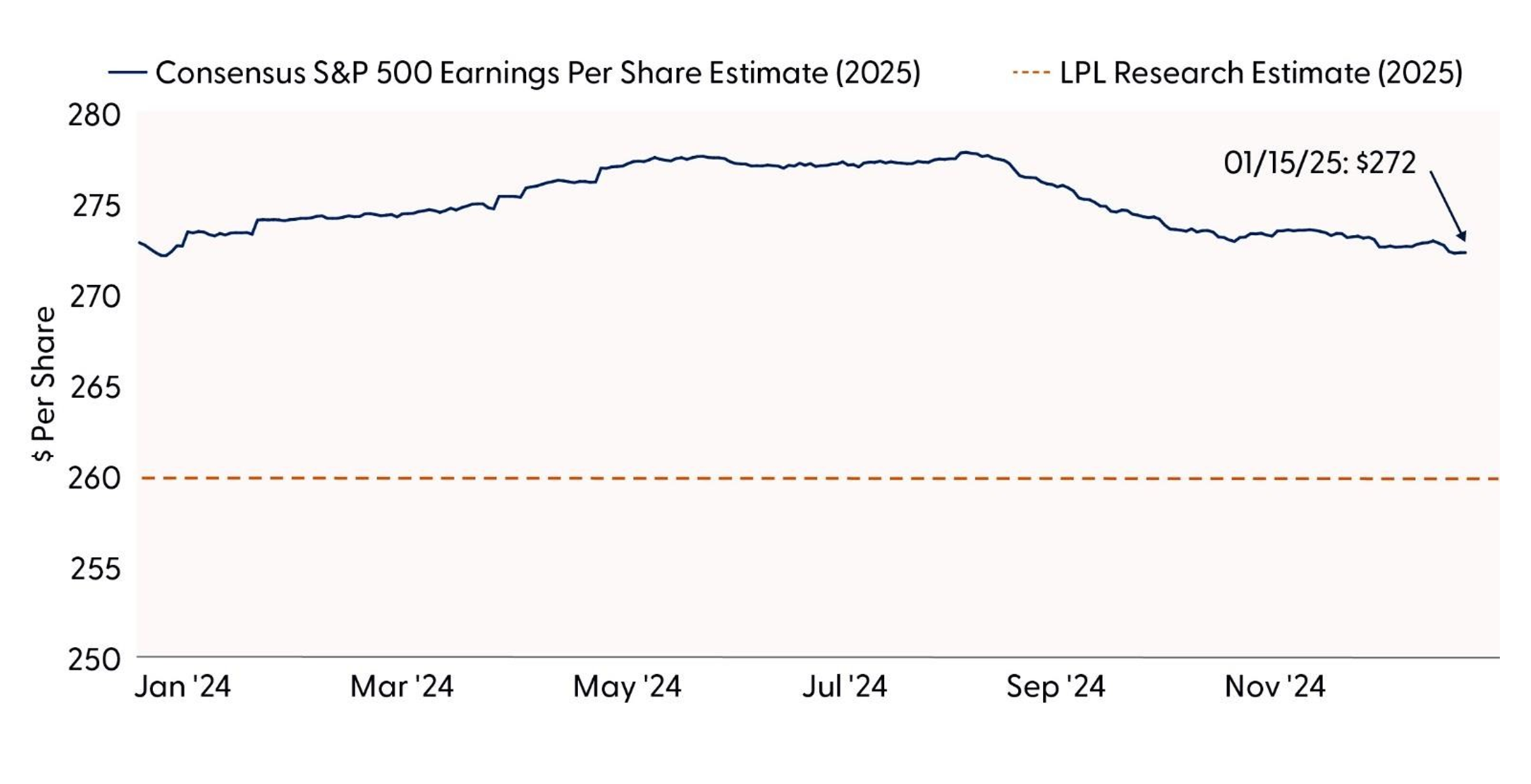

As we wrote in our Outlook 2025: Pragmatic Optimism, we believe corporate America has an excellent chance to deliver double-digit earnings growth in 2025 and even exceed our forecast for S&P 500 EPS of $260 per share.

Broadly, corporate America will get help from artificial intelligence (AI) investment and related productivity gains. Banks and energy companies should benefit from deregulation in Washington, D.C. Economic growth, though likely to slow, may come in around 2%, if not higher, setting up revenue growth in the 4–5% range when factoring price increases in (remember GDP is reported without inflation, but company revenue is nominal, meaning it includes inflation).

Tariffs and trade tensions are a key risk to earnings this year. Tariffs could increase costs for producers (hurting margins) and restrict growth opportunities abroad. Tax cuts aren’t coming into 2026 and should not be factored into 2025 earnings estimates.

The accompanying chart illustrates the resilience of 2025 earnings estimates. We had expected them to come down further last fall, but a better-than-expected economy, AI strength, effective cost controls bolstering margins, and prospects for deregulation and other potential policy support from Trump 2.0 have given analysts confidence in low- to-mid teens earnings growth this year. We still believe $272 is too high, though we acknowledge $260 (about 9% growth) may be a bit too low if the bite from tariffs is limited and economic growth surprises to the upside.

Consensus Earnings Estimates for 2025 Held Up Well Over the Past Year

LPL Research’s forecast of $260 per share in S&P 500 earnings in 2025 could end up a little light

Source: LPL Research, FactSet, 01/16/25

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Conclusion

Expect corporate America to put up solid numbers this earnings season on the back of steady economic growth, despite the strong U.S. dollar. Financials and big tech will carry most of the load, offsetting energy weakness, but analysts and traders will be squarely focused on policy, particularly trade, in assessing the earnings outlook for 2025. How well estimates hold up will always play a key role in how stocks react to earnings season, but much of the focus this season will be on policy. We won’t get many answers there, making forecasting more difficult.

Regardless, prospects for double-digit earnings growth from S&P 500 companies this year are good, especially welcome news with the stock market trading at a rich price-to-earnings ratio near 22 times this year’s consensus S&P 500 EPS estimate.

Asset Allocation Insights

As 2025 begins, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S. over international and emerging markets, a slight tilt toward growth, and benchmark-like exposure across the market capitalization spectrum. The Committee recommends benchmark-level fixed income exposure, with an emphasis on intermediate maturities, and an allocation to preferred securities.

As discussed in our Outlook 2025: Pragmatic Optimism, we expect stocks to move modestly higher in 2025 while acknowledging reasonable upside and downside scenarios. We cannot rule out the possibility of short-term weakness as sentiment remains stretched and a lot of good news is priced into markets. Upside support could come from economic growth, a supportive Federal Reserve, strong corporate profits, and supportive policies from the Trump administration. The most likely downside scenarios involve re-accelerating inflation, higher interest rates, and geopolitical threats that do economic harm. If inflation re-accelerates, equities may need to readjust to what could be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products orservices. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

| Not Insured by FDIC/NCUA or Any Other Government Agency |

Not Bank/Credit Union Guaranteed |

Not Bank/Credit Union Deposits

or Obligations |

May Lose Value |

For public use. Member FINRA/SIPC.

RES-0002683-1224 Tracking #684721| #684723 (Exp. 01/26)

Q4 Earnings Preview: Mix of Solid Growth and Policy Uncertaint

What to Expect This Earnings Season

A Mix of Strong Growth and Policy Uncertainty. Analysts expect about 12% growth in S&P 500 EPS in the fourth quarter of 2024 currently. We expect limited upside to that estimate this quarter, partly due to the strong U.S. dollar. Excellent bank results last week got us off to a good start. Earnings growth will be strong enough that the amount of upside may not matter much. Given the expected drag from the energy sector, we’ll happily take 13–14%.

The key to the market’s reaction to results will be whether guidance is upbeat enough to keep market expectations for double-digit earnings gains in 2025 intact. To that end, trade policy expectations will be important factors, as we discuss below.

Fourth Quarter May Kick Off Run of Double-Digit Earnings Growth Quarters

Source: LPL Research, FactSet, 01/16/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

At a high level, solid economic growth to end the year puts corporate America in a good position to grow earnings by double-digits in Q4. The Atlanta Federal Reserve’s GDP tracker is calling for 3% GDP growth last quarter, nicely ahead of economists’ consensus forecast of 2.3% (source: Bloomberg). The Institute for Supply Management (ISM) Manufacturing Index, which has historically been correlated to S&P 500 earnings, rose two points during the quarter, though it remains slightly below the expansion/contraction breakpoint of 50. The holiday shopping season was strong with sales gains of around 4%, above the National Retail Federation’s prediction and powered by strong e-commerce sales.

Easy comparisons don’t hurt, as banks took special charges in the fourth quarter of 2023 to replenish the FDIC’s rescue fund after the regional bank crisis earlier that year. That means big increases in bank earnings will be easy to come by when compared to depressed year-ago results. In fact, the financials sector is likely to drive half of overall S&P 500 EPS growth in Q4. That’s more than the five points of earnings growth contribution expected to come from the Magnificent Seven (the seven biggest market-cap companies in the U.S. which are all technology-oriented). As noted in the “Expect Big Growth Divergences Among Sectors This Earnings Season” chart, financials and the big growth sectors are where most of the earnings strength will come from.

Pushing in the other direction will be a strong dollar, higher borrowing rates, slowing growth in Asian tech exports to the U.S. (indicative of technology product demand), and a sizable drag from the energy sector. Energy is likely to be a two-point drag on S&P 500 EPS if the expected 30% year-over-year drop in sector earnings comes to fruition.

Expect Big Sector Growth Divergences During This Earnings Season

Most of the earnings growth in Q4 will be driven by financials and the big growth sectors

Source: LPL Research, FactSet, 01/16/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Trade policy and tariffs will likely be a topic of discussion on nearly every earnings conference call for the big multinational corporations that compose the bulk of the S&P 500. Tariffs won’t impact last quarter’s results, but they will have a lot to say about how earnings in 2025 shape up. Remember, tariffs can be raised with executive orders, so they can, for the most part, be implemented immediately without congressional approval. At this point, we don’t know how deep or broad the tariffs will be, but they are likely to cause a bit of a squeeze on profit margins for companies that import materials and unfinished goods from China and throughout Europe and Southeast Asia.

Some of those tariffs will be passed on to consumers in the form of higher prices, which is why some worry they will be inflationary (they might be, but only temporarily). Some tariffs will be absorbed by foreign producers and U.S. wholesalers rather than U.S. consumers (the impact of tariffs on consumer inflation in 2018 was minimal). Foreign currencies may weaken further, minimizing the impact. And many tariff exceptions will likely be granted as trade negotiations play out. Nonetheless, trade uncertainty is high, and retaliation is possible if U.S. actions are more aggressive than our trading partners will tolerate. Even our friend to the north is preparing retaliatory action with a possible tariff on Canadian oil exports to the U.S.

Also consider shifting supply chains to reduce reliance on China, which started in Trump 1.0 and may gain steam in Trump 2.0, comes at a cost (possibly benefiting the industrials sector, which we like, as well as India). And U.S. companies may lose market share to European and Asian competitors if trade tensions ratchet higher. This uncertainty is evident in the chart below.

Trade Policy Uncertainty Surged Ahead of Inauguration Day

Tariffs present a huge potential swing factor for earnings in 2025

Source: LPL Research, Baker, Bloom & Davis, Bloomberg 01/16/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Double-Digit Earnings Growth in 2025 Likely Within Reach

As we wrote in our Outlook 2025: Pragmatic Optimism, we believe corporate America has an excellent chance to deliver double-digit earnings growth in 2025 and even exceed our forecast for S&P 500 EPS of $260 per share.

Broadly, corporate America will get help from artificial intelligence (AI) investment and related productivity gains. Banks and energy companies should benefit from deregulation in Washington, D.C. Economic growth, though likely to slow, may come in around 2%, if not higher, setting up revenue growth in the 4–5% range when factoring price increases in (remember GDP is reported without inflation, but company revenue is nominal, meaning it includes inflation).

Tariffs and trade tensions are a key risk to earnings this year. Tariffs could increase costs for producers (hurting margins) and restrict growth opportunities abroad. Tax cuts aren’t coming into 2026 and should not be factored into 2025 earnings estimates.

The accompanying chart illustrates the resilience of 2025 earnings estimates. We had expected them to come down further last fall, but a better-than-expected economy, AI strength, effective cost controls bolstering margins, and prospects for deregulation and other potential policy support from Trump 2.0 have given analysts confidence in low- to-mid teens earnings growth this year. We still believe $272 is too high, though we acknowledge $260 (about 9% growth) may be a bit too low if the bite from tariffs is limited and economic growth surprises to the upside.

Consensus Earnings Estimates for 2025 Held Up Well Over the Past Year

LPL Research’s forecast of $260 per share in S&P 500 earnings in 2025 could end up a little light

Source: LPL Research, FactSet, 01/16/25

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Conclusion

Expect corporate America to put up solid numbers this earnings season on the back of steady economic growth, despite the strong U.S. dollar. Financials and big tech will carry most of the load, offsetting energy weakness, but analysts and traders will be squarely focused on policy, particularly trade, in assessing the earnings outlook for 2025. How well estimates hold up will always play a key role in how stocks react to earnings season, but much of the focus this season will be on policy. We won’t get many answers there, making forecasting more difficult.

Regardless, prospects for double-digit earnings growth from S&P 500 companies this year are good, especially welcome news with the stock market trading at a rich price-to-earnings ratio near 22 times this year’s consensus S&P 500 EPS estimate.

Asset Allocation Insights

As 2025 begins, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S. over international and emerging markets, a slight tilt toward growth, and benchmark-like exposure across the market capitalization spectrum. The Committee recommends benchmark-level fixed income exposure, with an emphasis on intermediate maturities, and an allocation to preferred securities.

As discussed in our Outlook 2025: Pragmatic Optimism, we expect stocks to move modestly higher in 2025 while acknowledging reasonable upside and downside scenarios. We cannot rule out the possibility of short-term weakness as sentiment remains stretched and a lot of good news is priced into markets. Upside support could come from economic growth, a supportive Federal Reserve, strong corporate profits, and supportive policies from the Trump administration. The most likely downside scenarios involve re-accelerating inflation, higher interest rates, and geopolitical threats that do economic harm. If inflation re-accelerates, equities may need to readjust to what could be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products orservices. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

or Obligations

May Lose Value

For public use. Member FINRA/SIPC.

RES-0002683-1224 Tracking #684721| #684723 (Exp. 01/26)