As you near retirement, it’s likely you’ll have many questions about Social Security. How much will your retirement benefit be? When should you apply? Will earnings from a part-time job affect your benefit? Social Security has always been a major source of income for many retirees, but with fewer companies offering traditional pensions, Social Security is playing an even more important role in retirement income planning. Not only can Social Security help protect you against risks that retirees often face, including longevity risk (the risk of outliving your retirement income) and inflation risk (the risk that your income won’t keep up with the rising cost of living), but it also offers built-in benefits for your family members and survivors.

When planning your retirement income strategy, you should be aware of three advantages that Social Security offers:

A steady stream of lifetime income

Social Security provides a steady source of retirement income that you can’t outlive. Although you may not be able to rely on Social Security as the sole source of your retirement income, your benefit can serve as the foundation of your retirement income plan.

Annual inflation adjustments

Your Social Security benefit provides some protection against inflation risk. Your benefit is subject to automatic annual cost-of-living adjustments (COLAs) that will generally increase the amount you receive by a certain percentage each year to help offset the effects of inflation. COLAs are payable in most years but are not guaranteed.

Benefits for eligible family members and survivors

After you retire, certain members of your family may also be eligible for benefits based on your Social Security record, which may increase your household income. They may receive continuing income from survivor benefits upon your death as well. Eligible family members may include your spouse, your minor children, and your dependent parents. The amount they receive will depend on your earnings and other factors.

How much will you receive?

Your Social Security retirement benefit is based on the number of years you’ve been working and the amount you’ve earned. When you become entitled to retirement benefits, the Social Security Administration (SSA) calculates your primary insurance amount (PIA), upon which your retirement benefit will be based, using a formula that takes into account your 35 highest earnings years.

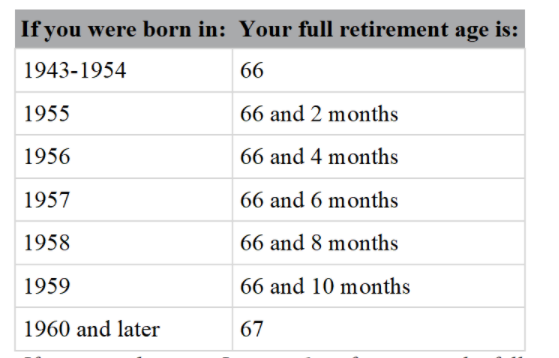

Your age at the time you begin receiving Social Security also affects your retirement benefit. If you were born in 1943 or later your full retirement age is 66 to 67, depending on your year of birth. Electing to receive benefits before your full retirement age (you can receive benefits as early as age 62) will result in a lower benefit than if you had waited until full retirement age to begin receiving Social Security. If you delay receiving benefits past your full retirement age, you can receive delayed retirement credits that will increase your benefit by a certain percentage for every month you wait, up until age 70.

Receiving benefits at full retirement age

At full retirement age, you will be eligible for full Social Security benefits (100 percent of your PIA), provided that you have worked in a job covered by Social Security and meet other eligibility requirements. Your full retirement age depends upon the year in which you were born.

If you were born on January 1st of any year, the full retirement age for the previous year applies.

Receiving benefits earlier than full retirement age

The minimum age at which you can retire and receive Social Security retirement benefits is currently 62. At age 62, you will be eligible for reduced retirement benefits based on a percentage of your PIA, provided that you are fully insured. Your retirement benefit will be reduced by 5/9ths of 1 percent (or 0.55556 percent) for every month between your retirement date and full retirement age, up to 36 months, then by 5/12ths of 1 percent thereafter. This reduction is permanent; when you reach full retirement age, you will not be eligible for a benefit increase. However, it may still make sense to receive benefits early, because you may receive benefits over a longer period of time.

Mimi decides to begin collecting her Social Security benefit at age 62, five years before her full retirement age of 67. As a result, she will receive 30 percent less per month than if she had waited until her full retirement age. However, she will receive 60 more benefit checks than if she had waited until full retirement age.

Receiving benefits later than full retirement age

You will permanently increase your retirement benefit for each month that you delay receiving Social Security retirement benefits past your full retirement age. Your benefit will increase by a predetermined percentage for each month you delay receiving retirement benefits up to the maximum age of 70. If you were born in 1943 or later, your benefit will increase by 2/3 of 1 percent for each month you delay receiving retirement benefits (8 percent per year).

Robert, who was born in 1950, will receive a $1,000 monthly retirement benefit at age 66. He decides to delay collecting Social Security until age 70, four years after his full retirement age of 66. At age 70, his retirement benefit will be $1,320, which is 32 percent higher than it would be if he had collected benefits at his full retirement age.

You can estimate your benefits under current law by using the benefit calculators available on the Social Security website. You can also sign up to view your online Social Security Statement there. Your statement contains a detailed record of your earnings, as well as estimates of retirement, survivor, and disability benefits. If you’re not registered for an online account and are not yet receiving benefits, you’ll receive a statement in the mail every year, starting at age 60.

When should you begin receiving Social Security benefits?

Should you begin receiving Social Security benefits early, or should you opt to wait until full retirement age or even longer? Obviously, if you need the money right away, your decision is clear cut. But otherwise, there’s no ”right” time to begin receiving Social Security benefits; it depends on your personal circumstances, and there are many variables. Here are some questions that can help you make your decision.

Are you planning to work?

It may be advantageous to work as long as possible if you want to increase your Social Security retirement benefit because your PIA will be recalculated annually if you have had any new earnings that might result in a higher benefit. However, although you can work and still receive Social Security, if you’re under full retirement age, wages you earn as an employee (or net earnings from self-employment income) may reduce your retirement benefit. If you’re under full retirement age for the entire year, $1 in benefits will be withheld for every $2 you earn over the annual earnings limit ($19,560 in 2022). A higher earnings limit applies in the year you reach full retirement age, and the calculation is different, too–$1 in benefits will be withheld for every $3 you earn over $51,960 (in 2022).

If your earnings will be high enough to affect your Social Security benefit, you may want to consider waiting until full retirement age to begin receiving benefits, because once you reach full retirement age, you can earn as much as you want, and your benefit won’t be affected.

The benefit reduction is based on your annual earnings and is not permanent; your monthly benefit is reduced starting in January of the year following the year you had excess earnings and will be reduced until the excess earnings are used up. Additionally, if your monthly benefit is reduced in the short term due to your earnings, you’ll receive a higher monthly benefit later. That’s because the SSA recalculates your benefit when you reach full retirement age, and omits the months in which your benefit was reduced.

Will Social Security be around when you need it?

You’ve probably heard media reports about the worrisome financial condition of Social Security, but how heavily should you weigh this information when deciding when to begin receiving benefits? While it’s very likely that some changes will be made to Social Security (e.g., payroll taxes may increase or benefits may be reduced by a certain percentage), there’s no need to base your decision on this information alone. Although no one knows for certain what will happen, if you’re within a few years of retirement, it’s probable that you’ll receive the benefits you’ve been expecting all along. If you’re still a long way from retirement, it may be wise to consider various scenarios when planning for Social Security income, but keep in mind that there’s been no proposal to eliminate Social Security.

How long will retirement last?

Retirees must make sure that they have enough income to last for a lifetime. But how many years will that be? You can never know for sure, but you can make an educated guess by using calculators or tables to calculate your life expectancy, then factoring in that information when deciding when to take your Social Security benefits. You’ll also want to consider your current health and your family health history when deciding when to take your Social Security benefits. For example, if you have a serious health condition, you may decide to take benefits earlier. On the other hand, if you can reasonably expect to live well into your 80s or 90s, you may decide to delay receiving Social Security benefits so that you can increase your retirement benefit, and boost the odds that you’ll have enough income for the years ahead.

Calculating your “break-even” age can help you compare the long-term financial consequences of starting benefits at one age versus another. Your break-even age is the age at which the total accumulated value of your retirement benefits taken at one age equals the value of your benefits taken at a second age. Although many factors can affect this number, you’ll generally reach your break-even age about 12 years from your full retirement age if taxes and inflation aren’t accounted for. For example, if you begin receiving benefits at age 62, and your full retirement age is 66, you will generally reach your break-even age at 78. This calculation may vary by one to three years, depending on what factors are used.

However, unless you’re able to invest your benefits rather than use them for living expenses, your break-even age is probably not the most important part of the equation. For many people, what really counts is how much they’ll receive each month, rather than how much they’ll accumulate over many years.

How will your spouse be affected?

If you’re married, you and your spouse should consider how Social Security will affect your joint retirement plan. Are you both eligible for benefits? How much will you each receive? What are your combined life expectancies and break-even ages? These variables can affect the decisions you make regarding your Social Security benefits.

For example, the age at which you begin receiving benefits may significantly affect the amount of lifetime income your spouse or surviving spouse may receive. If your spouse has never worked outside the home or in a job covered by Social Security, or has worked but doesn’t qualify for a retirement benefit higher than yours based on his or her own work record, he or she may be able to receive a spousal retirement benefit based on your work record. At full retirement age, your spouse may be entitled to receive 50 percent of your full retirement benefit amount, and will generally be eligible for a survivor benefit equal to 100 percent of your benefit upon your death. If you’re the primary wage earner, it may make sense for you to delay receiving benefits, because the larger your benefit, the larger benefit your spouse may receive, both before and after your death. If your spouse’s life expectancy is much longer than yours, this can be an especially important consideration.

However, your spouse can’t file for spousal benefits based on your earnings record until you reach full retirement age and file for benefits.

What is the impact on your overall retirement income plan?

Any decisions you make regarding Social Security income should take into account other potential sources of retirement income, and your overall retirement income plan. For example, you may need to determine whether it’s wise to take early Social Security benefits so that you can delay withdrawing funds from tax-advantaged investments (e.g., 401(k) plans, 403(b) plans, or traditional IRAs), allowing them to continue to accumulate tax deferred. If you’re eligible for pension benefits, you’ll need to consider how Social Security impacts that income. For example, pension benefits from a job not covered by Social Security may be reduced (offset) by any Social Security income you receive.

Another major consideration is your tax situation. If the only income you had during the year was Social Security income, then your benefit generally won’t be taxable. However, other income you receive during the same year (generally earned income or substantial investment income) may trigger taxation of part of your Social Security benefit. It’s important to look at how other sources of income are taxed and how your overall tax liability might be affected when considering when to take your Social Security benefits.

The rules surrounding taxation of Social Security benefits are complex. The IRS has a worksheet you can use to determine whether or not your Social Security benefits are taxable. You can find this worksheet and more information about the taxation of Social Security benefits in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits. You may want to speak to a tax professional about your specific situation.

How do you apply for Social Security benefits?

According to the SSA, you should apply for Social Security benefits approximately three months before your retirement date. No matter when you apply for Social Security, you’ll be eligible for Medicare at age 65, so make sure you contact the SSA three months before you turn 65 even if you plan to retire later. To apply for Social Security benefits, you can fill out an application on the SSA website (ssa.gov), or call or visit your local Social Security office. You can also call the SSA at (800) 772-1213 to discuss your options or to get more information about the application process.

This article was prepared by Broadridge.

LPL Tracking #1-05097078